Losing Pinterest

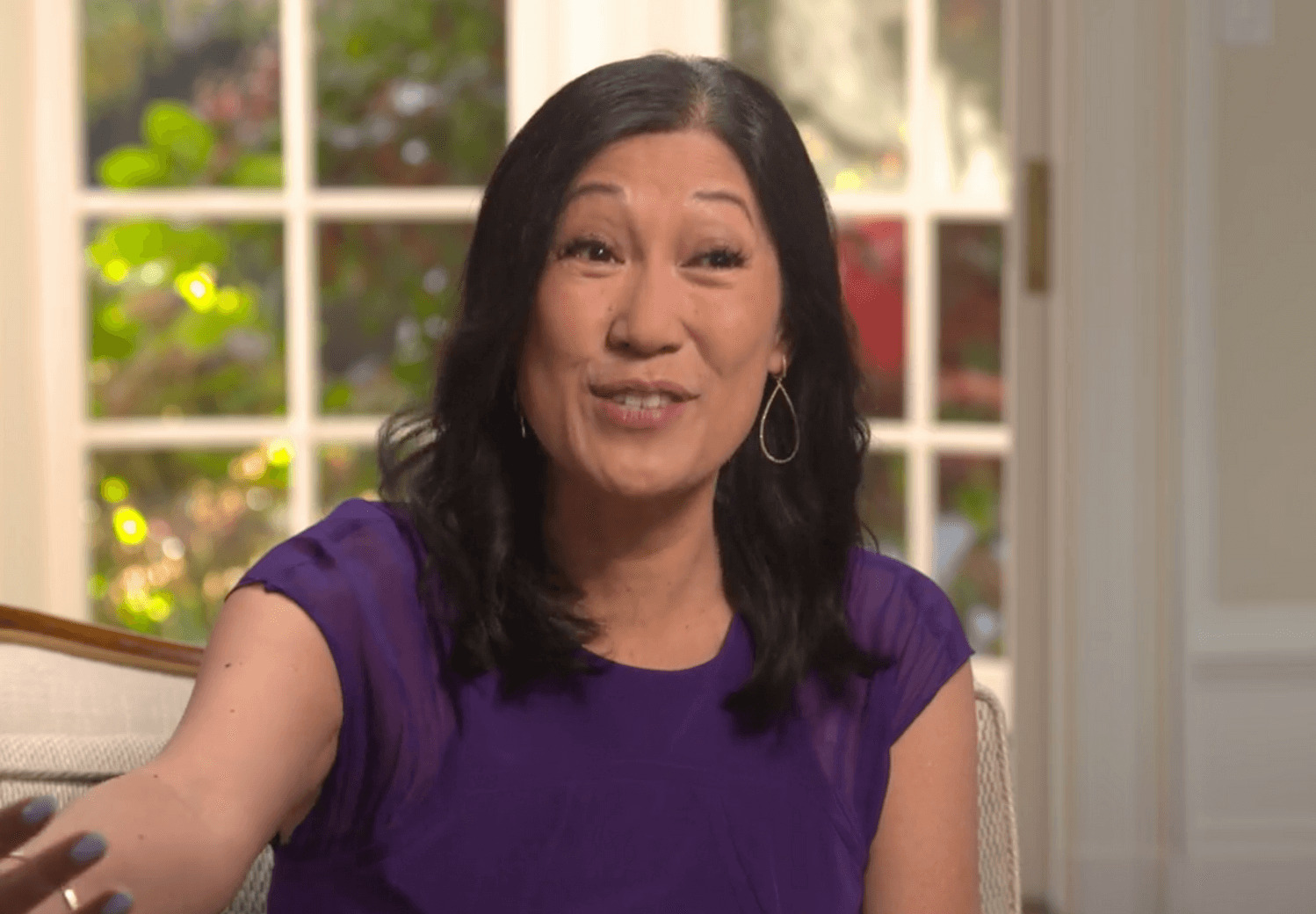

Theresia Gouw

12.22.20

Many venture capitalists lose sleep over "the one that got away" - a company that they passed up investing in, which later turned out to be a massive success. Though she has experienced many successful investments, Theresia Gouw is not immune to this classic VC mistake!

Summary:

Many venture capitalists lose sleep over “the one that got away” – a company that they passed up investing in, which later turned out to be a massive success. Though she has experienced many successful investments, Theresia Gouw is not immune to this classic VC mistake!

Thuy

Theresia Gouw

Thuy

Theresia Gouw

Thuy